Designing an instant, flexible payout system that keeps sellers engaged on platform

Role

Product Designer

Duration

3 months

Team

Product manager, UI Designer,Engineers,Content designer.

Background

Historically, sellers received earnings from their sale through standard bank transfers, which could take several days and often resulted in funds leaving the platform immediately. This limited opportunities for reinvestment and reduced seller engagement on platform. The vision was to create a secure, trackable digital wallet that would hold the proceeds from sales instantly, enabling sellers to either spend directly on MPB through purchases and trades or withdraw at their convenience.

The goal

Design an instant, secure MPB Wallet that becomes the default way sellers receive earnings from sales and trades.

How did this come about?

There was a growing need to improve seller retention and keep value circulating within MPB. Sellers were receiving payouts through standard bank transfers, which could take several days to arrive and often left the platform immediately. This meant missed opportunities for reinvestment, reduced engagement, and limited ways for sellers to interact with MPB after a sale.

Sellers needed an easy, instant way to access their earnings and the flexibility to either reinvest them on MPB or withdraw when needed. By making Sell Balance the default, sellers can experience immediate benefits that encourage them to stay active, sell more, and keep their funds in the ecosystem.

Challenges

• We needed to move fast. The ambition for Sell Balance was high, but speed was essential to start delivering value early. This meant prioritising the most impactful capabilities for launch while keeping the long-term vision in sight.

• The scope was huge. Sell Balance touched almost every part of the MPB platform, from the seller and trader journeys, to the buy journey, to returns and required significant updates to finance and fraud reconciliation processes as well as internal tooling, along with updates to knowledge bases, Help Centre articles, and even internal training documentation.

• Stakeholder alignment was critical. The size of the project meant collaborating across multiple teams: Product, Engineering, Finance, Legal, Fraud, and Customer Experience, while designing for a wide range of edge cases to ensure the experience was robust from day one.

These challenges meant the planning for Balance had to be robust and detailed from the onset

The approach

Kick-off and alignment

We began with a cross-functional workshop that brought together Product, Engineering, Finance, Fraud, and Customer Experience teams. This session aligned everyone on the vision for Sell Balance, its impact across the business, and the delivery timelines. It was as much about onboarding the team into the why as it was about defining the how.

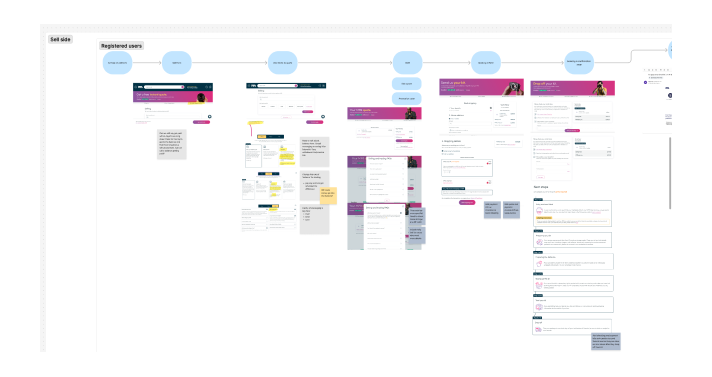

Mapping the end-to-end ecosystem

With alignment secured, we moved into an in-depth mapping exercise to understand the scale of Sell Balance across the MPB platform. I facilitated a journey mapping process that broke down every customer touchpoint it would influence spanning seller and trader flows, buying journeys, returns, and internal operational processes. This included identifying both happy paths and unhappy paths, which revealed where the customer experience could break and where additional safeguards or education might be needed.

Requirements definition with stakeholders

Using the mapped journeys as a reference point, I partnered with the Product Manager to run structured requirements gathering sessions with all core stakeholders. This process ensured we captured not just functional requirements, but also operational and compliance considerations from teams like Finance, Fraud, and Legal. By having these conversations early, we reduced the risk of downstream blockers and aligned everyone on non-negotiables before design began.

Designing for scale and trust

The ideation phase began with rapid wireframing to explore different ways sellers could view, access, and use their balance in a way that felt immediate yet secure. Each iteration considered not just the primary user flow, but also the edge cases surfaced in earlier mapping from fraud holds to KYC verification triggers. As the concepts matured, they evolved into high-fidelity prototypes fully integrated with MPB’s design system, ensuring the experience would scale across markets without requiring heavy localisation or customisation.

Validation and iterative refinement

Before locking the final direction, we conducted usability sessions with sellers to test comprehension, trust, and ease of use. These sessions surfaced subtle but critical adjustments from clarifying withdrawal language to making transaction history more scannable. Final refinements were made following a comprehensive stakeholder review, ensuring the experience balanced seller needs, business objectives, and operational realities.

What we delivered

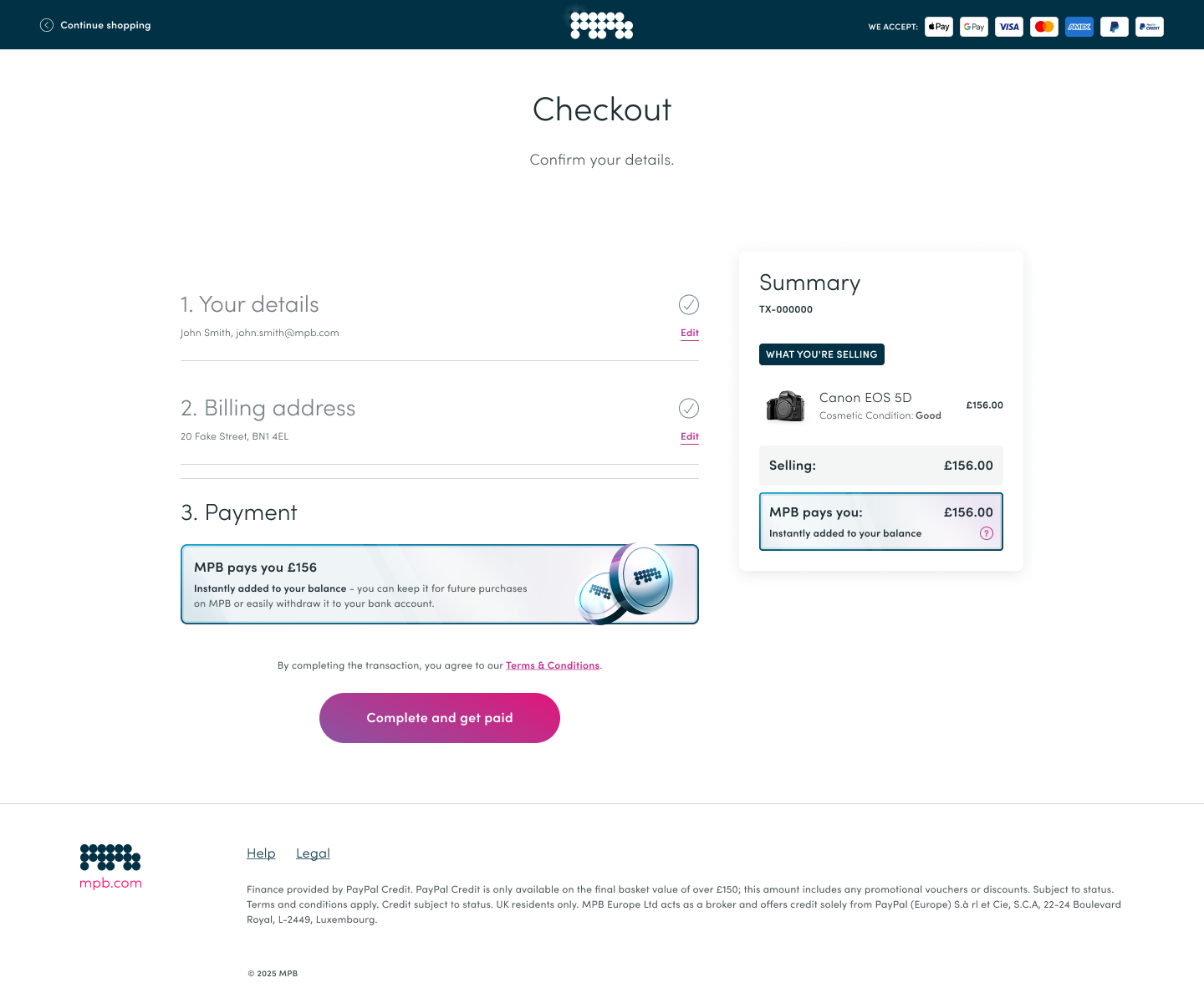

Embedding Sell Balance into the seller experience

We introduced prominent messaging across the seller journey, highlighting instant earnings in MPB sell Balance

We expanded and redefined critical education touchpoints with the Selling and trading FAQs to pre-empt common questions about payout, timelines and Balance usage

Balance components were introduced across the journey which added transparency within the summary flow

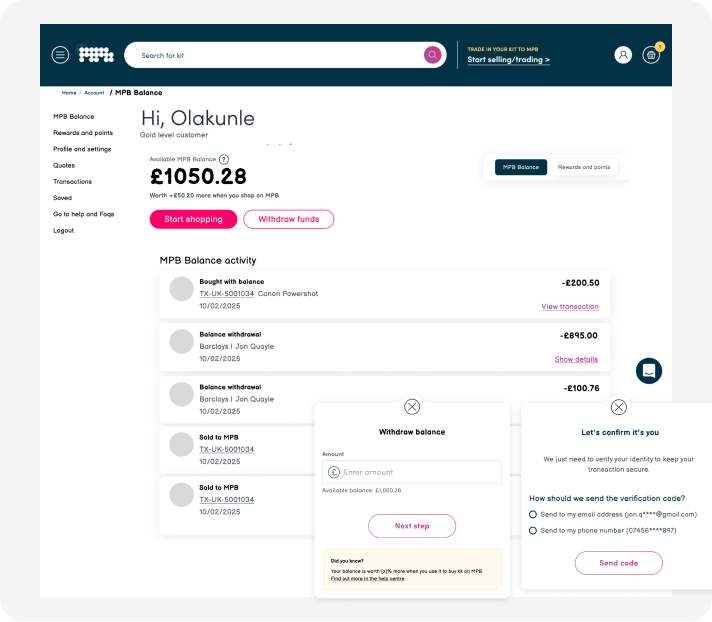

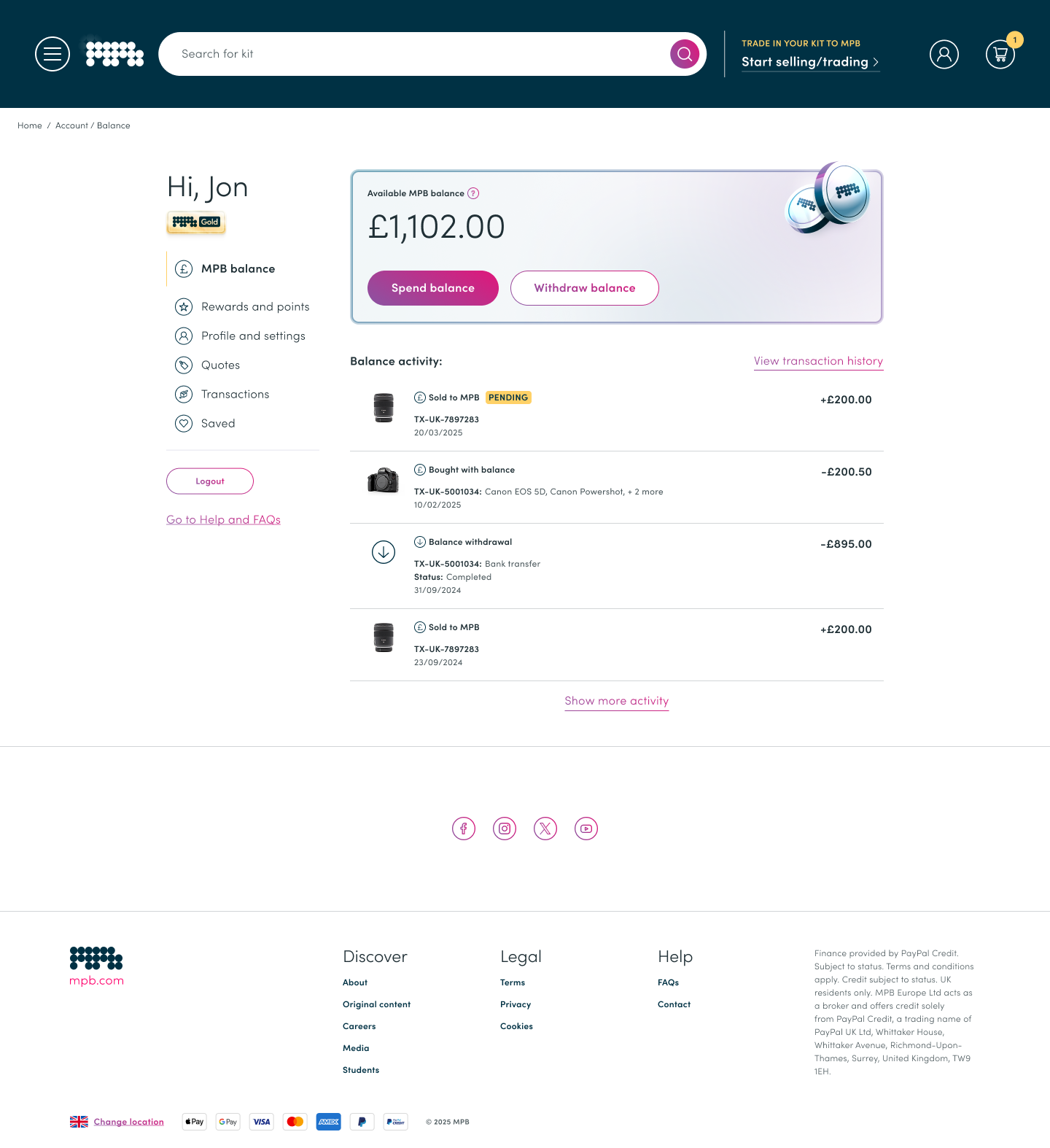

Balance hub

Sellers now have a single, dedicated page in their account to view and manage their earnings. The page provides full visibility and control over their Balance, enabling them to act instantly. Key functionalities include:

• View available Balance in real time

• Spend Balance directly on MPB for purchases or trades

• Track Balance activity: earnings in, platform spend, and withdrawals

• Withdraw funds instantly at any time

Seamless, integrated buyer journey

Sellers with available funds can now see their Balance directly on product pages, making it easier to understand their purchasing power before they even reach checkout. At checkout, their Balance is automatically applied to the order total, with the flexibility to combine it with an external payment method if needed.

• Available Balance is displayed on Product pages

• Balance fund is auto applied to checkout total

• Option to combine Balance with third-party payment methods

What we delivered (UI snapshot)

Takeaways

• Clarity and alignment from the start is essential: Mapping out seller, buyer, and internal team journeys early ensured the design accounted for every touchpoint, reducing the risk of surprises later in development.

• Designing for the ecosystem, not just a feature : Balance required thinking beyond a single flow to create a consistent, integrated experience across seller journeys, buyer journeys, and operational tools

• Flexibility was built in from day one : The designs support multiple scenarios and edge cases, giving engineering and product teams the adaptability to handle evolving requirements without redesigning core elements.